closed end fund liquidity risk

Nearly 80 products have been launched during the last four years and another 47 sit in registration. T 353 01 224 6000 Bosca PO 559 Baile Átha Cliath 1 PO Box 559 Dublin 1 wwwcentralbankie 10 March 2021 RE.

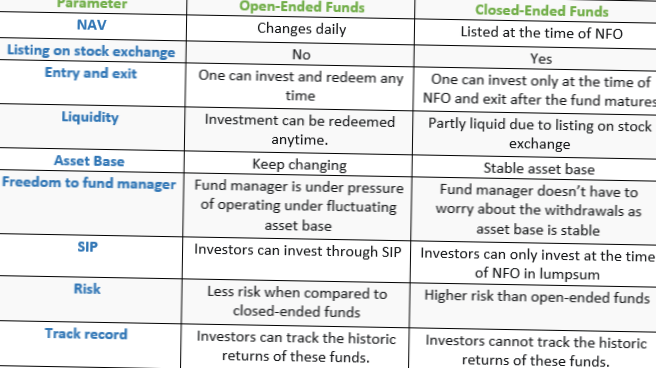

Difference Between Open Ended And Closed Ended Mutual Funds Differbetween

Liquidity Risk - The risk that the market cannot accommodate the size of an order to buy or sell a security within the desired timeframe.

. The results of the study indicate that closed-end fund discounts increase closed-end fund market prices are lower relative to net asset value as. Political Risk - The risk that an investment in a foreign security or fund will be impacted adversely as the result of unfavorable political developments. With open-ended funds the fund company must accept your redemption whenever you want.

CEFs are exposed to much of the same risk as other exchange traded products including liquidity risk on the secondary market credit risk concentration risk and discount risk. Fixed income investments are subject to interest rate risk and their value will decline as interest rates rise. Closed end investing involves risk.

Ad EY Provides Deep Knowledge Practical Support to Help Clients Manage Liquidity Challenges. A closed-end fund issues shares only once. Investing Previous Post Next Post.

Closed-end funds can be subject to liquidity problems both at the level of the fund and at the level of the. A liquidity risk should be addressed only if a big part of your investment portfolio is not liquid. Additionally while a money market fund is an open-end management investment company money market funds are not subject to the rules and amendments we are adopting except certain amendments to Form N-CEN and Form N-1A and thus are not included when we refer to funds or open-end funds in this Release except where specified.

Find Out What Services a Dedicated Financial Advisor Offers. When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors.

Just like open-ended funds closed-end funds are subject to market movements and volatility. The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors interests in the fund. Closed-end funds can invest in a higher percentage of illiquid securities than open-end funds and can issue debt andor preferred shares.

The fluctuation of the income impacts the funds overall profitability. The only way to get into the fund later is to buy some of those existing shares on the open market. ESRB ESMA Liquidity risk project Dear Chair In August 2019 and April 2020 the Central Bank of Ireland Central Bank wrote to fund.

Classification of the Liquidity of Fund Portfolio Investments. Closed-end funds are more likely than open-end funds to include alternative investments in their portfolios such a s futures derivatives or foreign currency. If the CEF includes foreign market investments it will be exposed to the typical foreign market risks including currency political and economic risk.

Liquidity risk is defined as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors interests in the fund. Fitch Ratings has affirmed the AA long-term ratings assigned to the following series of preferred shares issued by three BlackRock municipal closed-end funds CEFs. Liquidity risk management program rule1 demand for asset classes that are not suitable for open-end funds which must provide for daily redemption.

Examples of closed-end funds include. Notably closed-end funds make frequent use of. Key Steps to Manage Working Capital Now while Planning for Next and Beyond.

Fitch Ratings - New York - 11 Apr 2022. The investment return and principal value will fluctuate and investors shares when sold may be worth more or less than the original cost. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers.

Funds are required to assess manage and periodically review their liquidity risk based on specified factors. Mon 11 Apr 2022 - 350 PM ET. --5617 million of Series W-7 Variable Rate.

Diversification strategies do not ensure a profit and do not protect against losses in declining markets. If you look at those three big risks in closed end funds. Some closed end funds have more risk than others.

Unlisted closed-end funds also provide limited liquidity. Fitch Affirms BlackRock Closed-End Fund Preferred Shares. A funds Program should be reasonably designed to assess and manage the funds particular liquidity risks and must incorporate certain specified elements.

The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF. Leverage tends to increase volatility for closed-end bond funds. Changes in interest rate levels can directly impact income generated by a CEF.

Ad Financial Advisors Offer Many Services Insights for Saving. Sensitivity To Interest Rates An interest rate may impact the cost of a CEFs debt which it uses to buy securities. The unlisted closed-end fund structureprimarily interval funds and tender-offer fundsallows asset managers to access the mass affluent market while addressing the liquidity challenges of alternatives and illiquid securities.

And a weak market for traditional closed-end fund initial public offerings. Diversified by asset strategy manager. The value of a CEF can decrease due to movements in the overall financial markets.

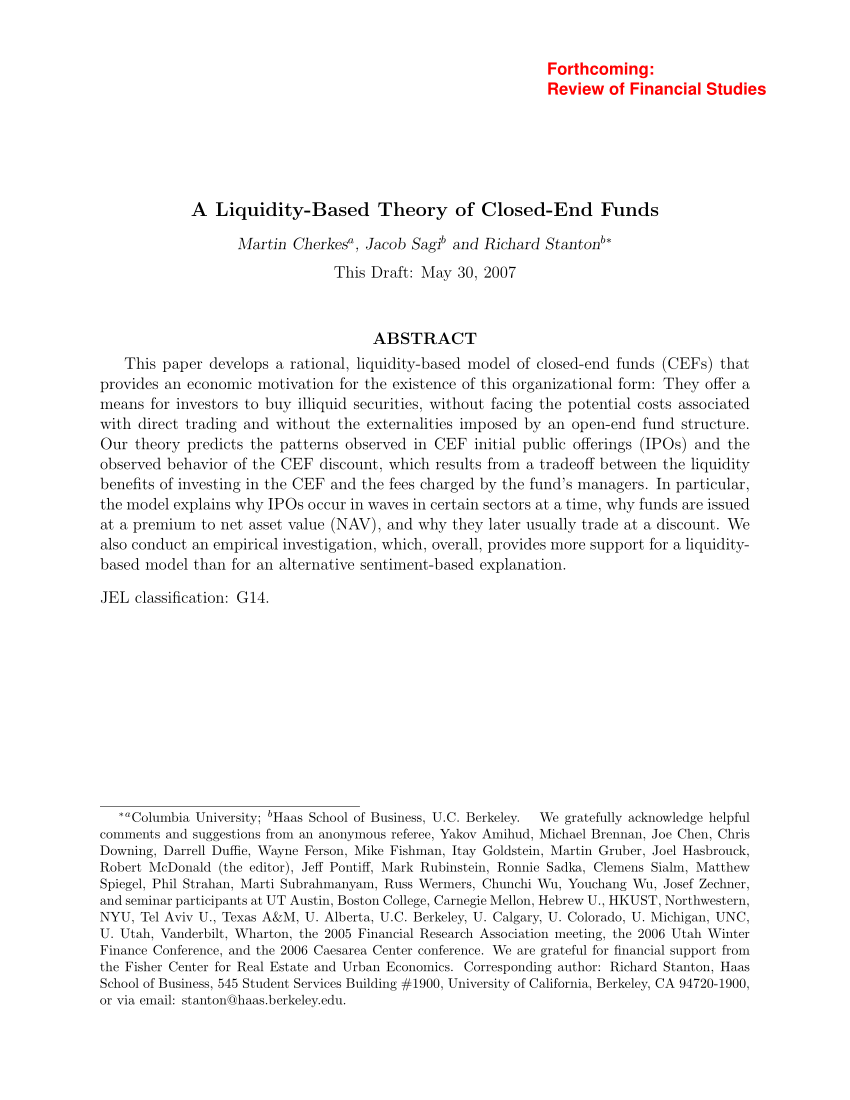

Pdf A Liquidity Based Theory Of Closed End Funds

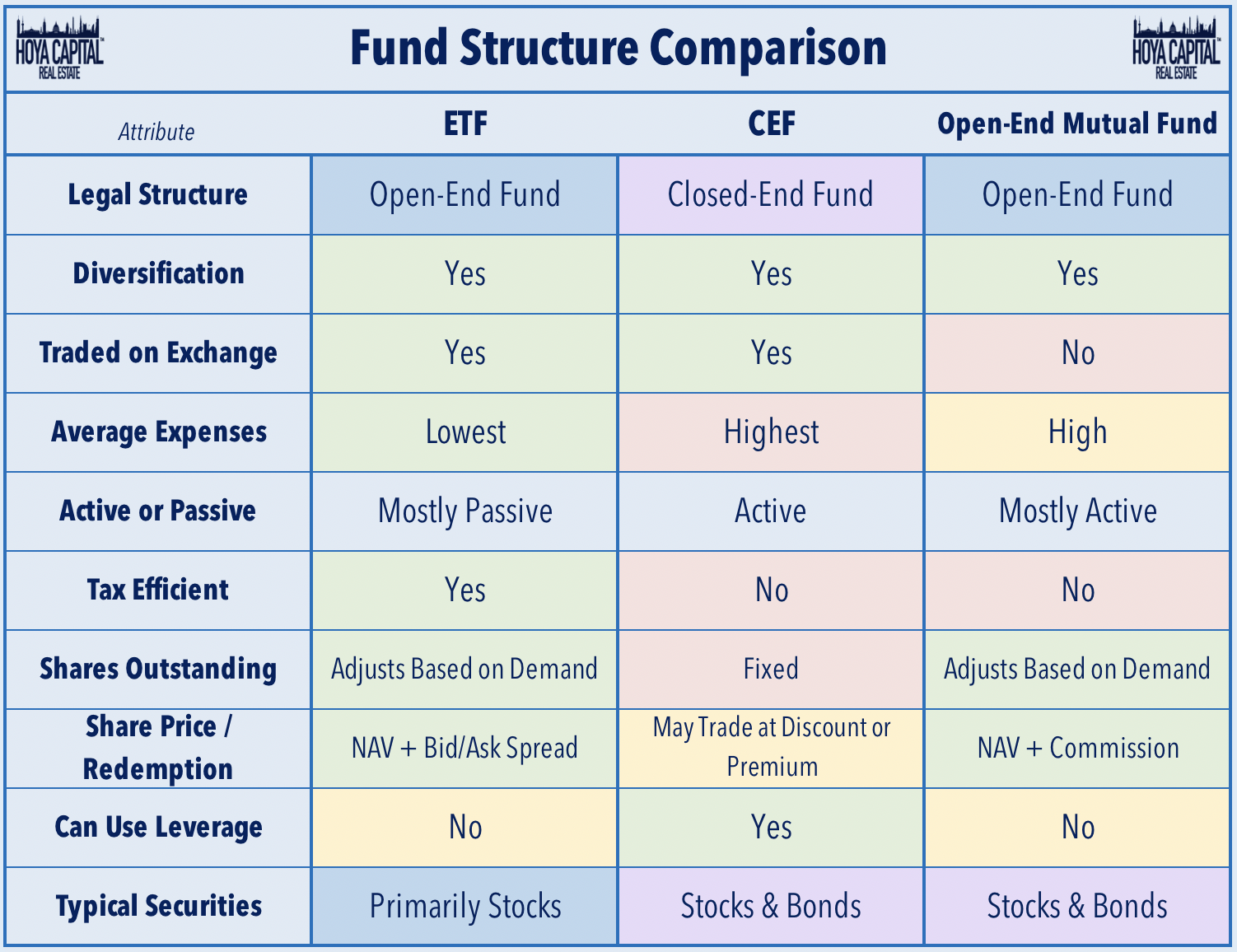

Real Estate Cefs Satisfying A High Yield Fix Seeking Alpha

Open Ended Mutual Fund Vs Close Ended Mutual Fund What To Prefer

A Closer Look At Closed End Funds Fundx Insights

Tourshabana What Are Closed End Vs Open End Mutual Funds Compare 4 Key Differences In Investing

Closed End Fund Definition Examples How It Works

Investing In Closed End Funds Nuveen

Closed End Fund Fs Investments

What Is The Difference Between Closed And Open Ended Funds Quora

Pdf A Liquidity Based Theory Of Closed End Funds

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Understanding Interval Funds Griffin Capital

A Guide To Investing In Closed End Funds Cefs Intelligent Income By Simply Safe Dividends

What Is The Difference Between Closed And Open Ended Funds Quora