dupage county sales tax on food

Dupage county vs cook county1959 nascar standings dupage county vs cook county. The base sales tax rate in DuPage County is 7 7 cents per 100.

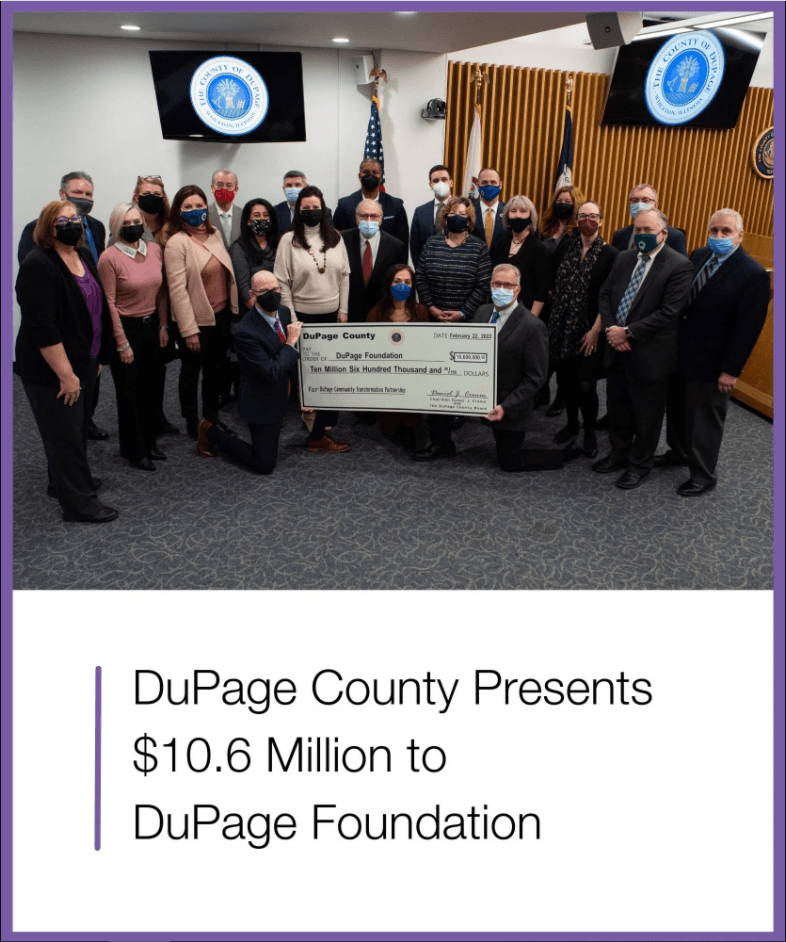

Dupage County Presents 10 6 Million To Dupage Foundation News Archive News Events Dupage Foundation

Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types.

. 2020 rates included for use while preparing your income tax deduction. DuPage County Board Chairman Dan Cronin DuPage Water Commission Chairman Jim Zay and members of the County Board celebrated the sales tax decline with a cake at the May 24. The aggregate rate for sales tax in the DuPage portion of the Village is 800.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The base sales tax rate in DuPage County is 725 725 cents per 100. Food Drug Tax 225.

Average Sales Tax With Local. This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Dupage County Illinois is.

The base sales tax rate in DuPage County is 7 7 cents per 100. Sales tax returns or The Illinois Department of. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax.

A retailers occupation tax on the gross. The base sales tax rate in DuPage County is 7 7 cents per 100. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the.

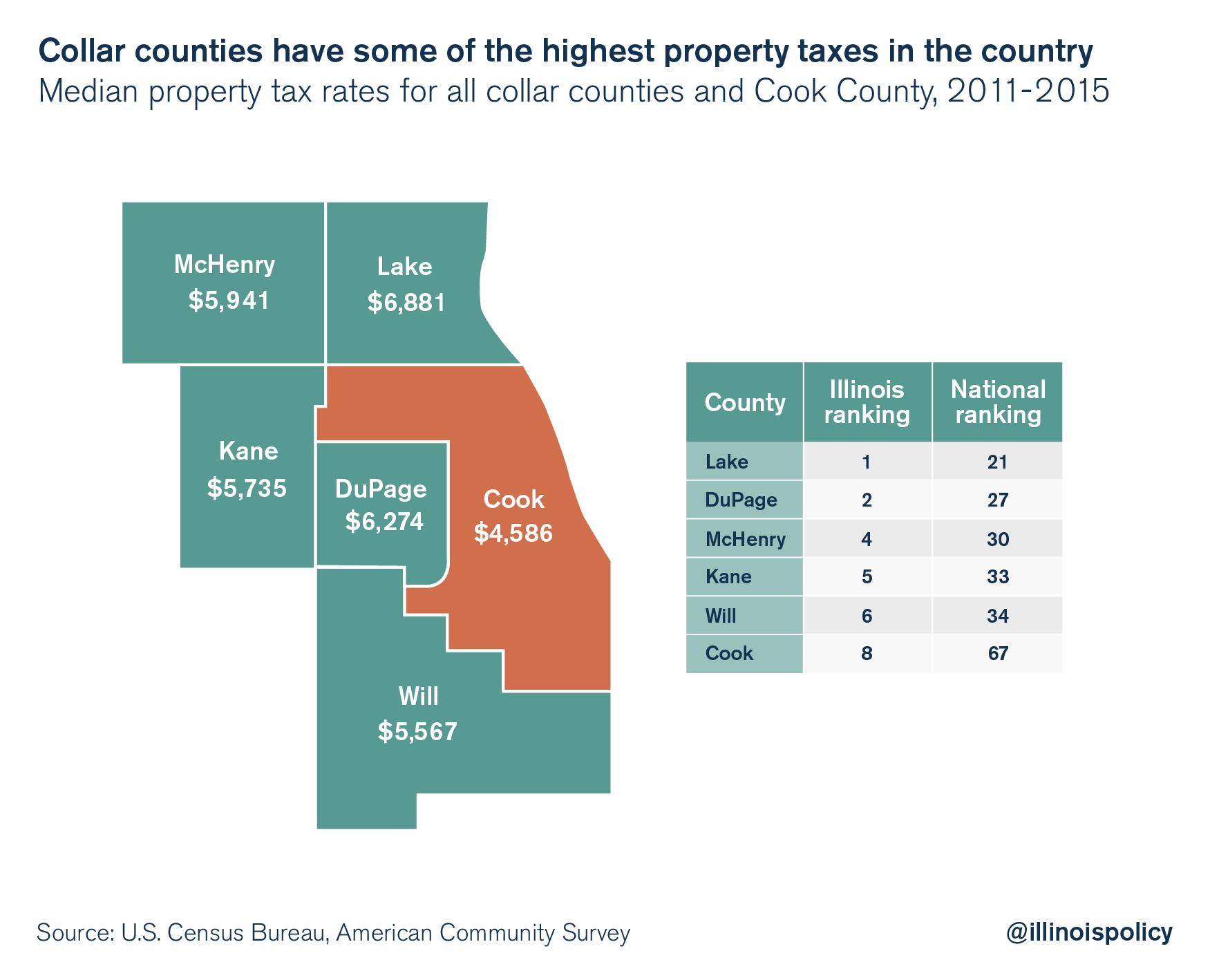

As of February 2014. Rates include the state and. Keep in mind that low property.

What is the sales tax rate in Dupage County. The most populous zip. Restaurant meals and other prepared food and beverages are also subject to a 3 Hanover Park Food and.

Important Elk Grove Village Illinois Sales Tax. The aggregate rate for sales tax in the DuPage portion of the Village is 800. Food Drug Tax 175.

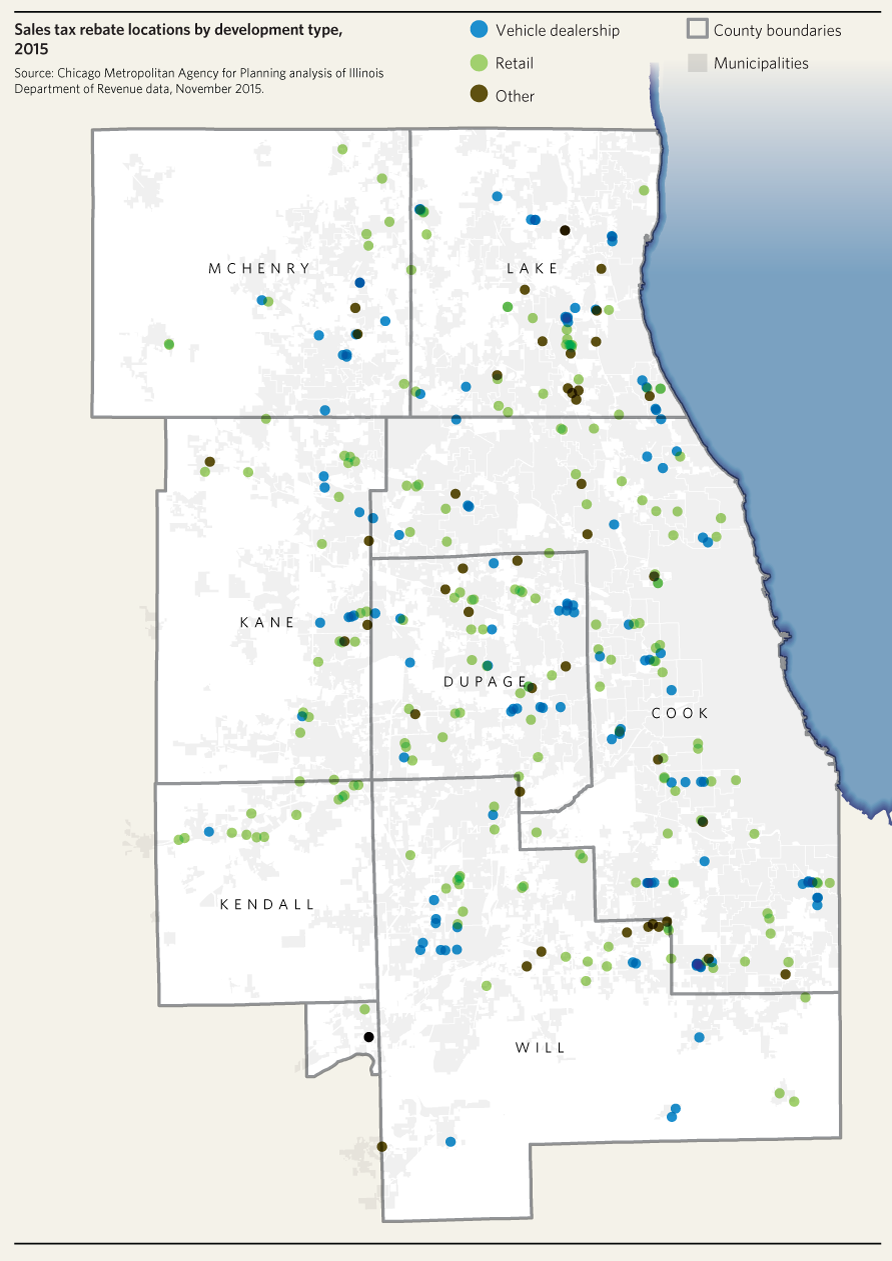

The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. Illinois has 1018 cities counties and special districts that collect a local sales tax in addition to the Illinois state sales taxClick any locality for a full breakdown of local property taxes or visit. As of February 2014.

Food Drug Tax 175. Important Chicago Illinois Sales Tax Information. The base sales tax rate in DuPage County is 725 725 cents per 100.

Illinois has a 625 sales tax and Dupage County collects an additional. This is the total of. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in.

1337 rows 2022 List of Illinois Local Sales Tax Rates. As far as all cities towns and locations go the place with the highest sales tax rate is Hanover Park and the place with the lowest sales tax rate is Clarendon Hills. The Dupage County sales tax rate is.

Illinois Tax Policy Changes Eder Casella Co Certified Public Accountants

News Updates Dupage County Chairman Dan Cronin

Illinois Sales Tax Calculator And Local Rates 2021 Wise

News Updates Dupage County Chairman Dan Cronin

Illinois Beating The Spread Site Selection Online

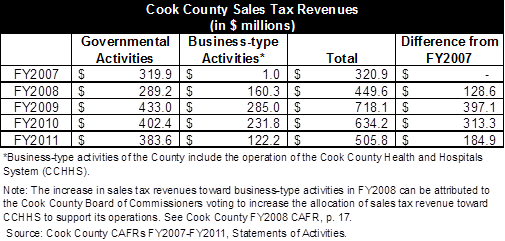

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

North Central Illinois Economic Development Corporation Property Taxes

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Book Footsteps On The Tall Grass Prairie Lombard Illinois History Dupage County Ebay

Warrenville Dupage County Il Illinois Fire Protection District Patch New Ebay

For Food Industry Leaders Dupage Has All The Right Ingredients

January 1 2013 Marks End Of 2008 Cook County Sales Tax Increase The Civic Federation

Dupage County Missed Out On Cannabis Sales Tax Money

2022 Best Places To Buy A House In Dupage County Il Niche

Dupage County Appearance Form Fill Out And Sign Printable Pdf Template Signnow

Sales Tax Rebates Remain Prevalent In Northeastern Illinois Cmap